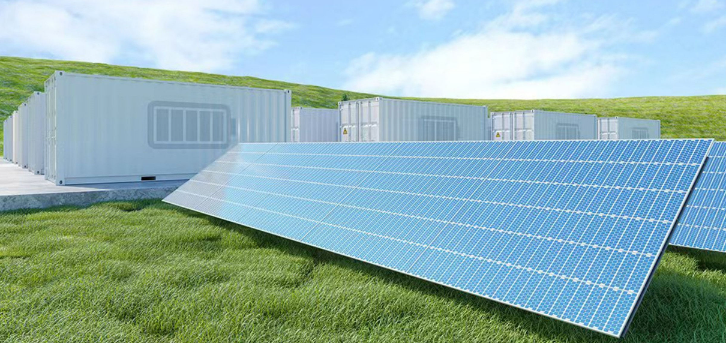

Carbon tariffs are coming! Industrial and commercial distributed photovoltaic power stations become a new and essential demand

The implementation of the EU Carbon Border Adjustment Mechanism (CBAM, also known as "carbon tariffs") is getting closer and there have been critical new developments recently. The European Parliament's Environment, Public Health and Food Safety Committee (ENVI) has officially passed the European Carbon Border Adjustment Mechanism (CBAM) agreement, which has received majority approval and will come into effect on October 1, 2023.

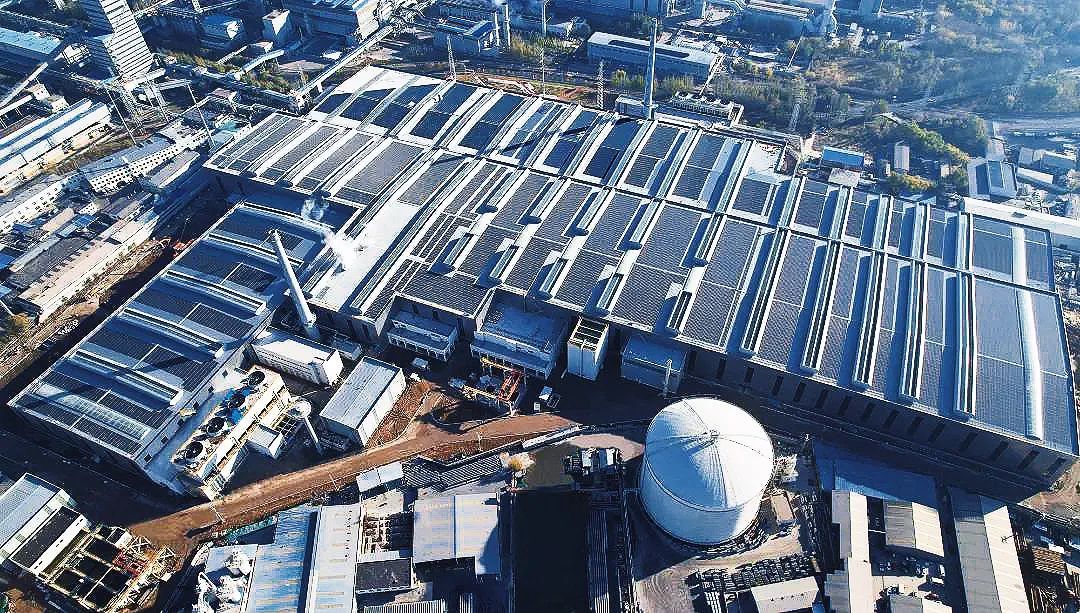

After the implementation of this regulation, the cement, steel, aluminum, and fertilizer industries will face pressure to pay carbon tariffs. Compared to bearing high carbon tariffs in the export process, many companies are more inclined to seek low-cost carbon reduction measures in the production process, and building photovoltaic power plants has become the main choice for carbon reduction.

Multiple industries affected, may become fortresses of green trade

Carbon tariff ", also known as carbon border adjustment mechanism or" carbon border adjustment tax ", refers to countries or regions that strictly implement carbon reduction policies, requiring them to pay (refund) corresponding taxes or carbon quotas when importing (exporting) high carbon products. According to regulations, as long as the carbon pricing of the production site (which may be carbon tax, carbon fee, or recognized carbon trading system carbon price) is lower than the EU ETS carbon price, once imported into the EU customs territory, a CBAM certificate must be purchased to make up for the difference. Therefore, "carbon tariff" can also be referred to as CBAM.

According to the detailed rules of the CBAM draft, cement, steel, aluminum, and fertilizers will be included as the first batch of industries and will take effect during the transition period from October 1, 2023 (no fees need to be paid during the transition period, but carbon information such as carbon emissions and paid carbon prices must be provided), and will fully take effect on January 1, 2026. Importers from EU countries must declare the specific quantity and carbon emissions of goods imported in the previous year annually. The EU will adjust the purchase and issuance of CBAM certificates based on the declared quantity. For export enterprises, this will inevitably increase production costs, weaken product competitiveness, and even eliminate some high polluting and high energy consuming enterprises.